The federal reserve is trying its best to tame the rising inflation, but things don’t seem to be going so well. According to a Fed GDP tracker, the downturn might be on the horizon. If that’s true, things could change for the worse pretty quickly.

The Prediction

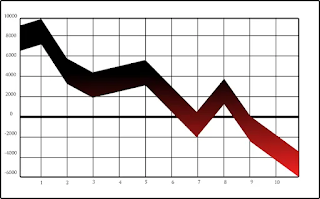

According to a measurement from the Atlanta Federal Reserve Bank, the US

economy might see a second-quarter decline in gross domestic product. The GDP

is the broadest measure of goods and services produced in any country.

The GDPNow tracker highlighted that the

economic growth in the spring was flat at 0%, while the estimates were 1.3% on

June 1 and 0.9% on June 8.

The Definition of Recession

A recession is usually defined as two

consecutive quarters of negative economic growth with other issues like falling

income, high unemployment, low or negative GDP growth, and slow retail sales.

The economic growth in the US is slowing

already. According to the Bureau of Labor Statistics, the gross domestic

product unexpectedly shrank in the first quarter of 2022 by 1.5%. If the

economy declines in the second quarter also, it will meet the technical

criteria for a recession.

Economists and Wall Street Firms Fear

Recession

Many economists and wall stress firms,

including Deutsche Bank, Bank of America, and Wells Fargo, estimate the

possibility of a recession within the next two years.

The Attempts by The Fed

The Fed is trying to avoid that by fighting

inflation. It is doing so by cooling customer demand to ensure prices stop

rising without crushing the demand excessively as it might lead to a recession.

It is trying to do so by increasing the benchmark interest rate. It increased

the same by 75-basis points on Wednesday. Another such hike is expected in

July.

Hiking interest rates usually creates

higher rates on business and consumer loans. It slows the economy by pushing

employers to reduce spending.

The central bank’s policy-setting Federal

Open Market Committee said this in a statement: “Inflation remains elevated,

reflecting supply and demand imbalances related to the pandemic, higher energy

prices, and broader price pressures. The committee is strongly committed to

returning inflation to its 2% objective.”

The statement also highlighted the

China lockdowns and the Russia-Ukraine war as key sources of inflation.

Possibility of a Global Recession

If a recession comes in the US, it might

also transform into a global recession. Andrea Dicenso, vice president and

alpha strategies portfolio manager at Loomis Sayles, thinks the chance of a

global recession is at 75%. She also added, “The Fed’s action yesterday, as

well as other coordinated central bank action, has led us to think that perhaps

that global recession is likely to be shallow and potentially already priced

into some assets.”

She also agreed that central banks might be

able to limit the economic damage once the worst of inflation passes.

US Economy is Strong

Celebrity investor Kevin O’Leary believes

that the US economy is much stronger than people think, and there’s “no

evidence” of an impending slowdown or recession yet. He said, ″I’m not saying

we won’t get one, but everybody that’s saying it’s coming around the corner

next week is just wrong.”

Sources:

https://www.foxbusiness.com/economy/us-economy-track-recession-fed-gdp-tracker-shows

https://indianexpress.com/article/business/economy/federal-reserve-hikes-rates-flags-slowing-economy-7972337/

https://vervetimes.com/a-shallow-recession-is-on-the-way-strategists-warn-heres-how-it-could-play-out/